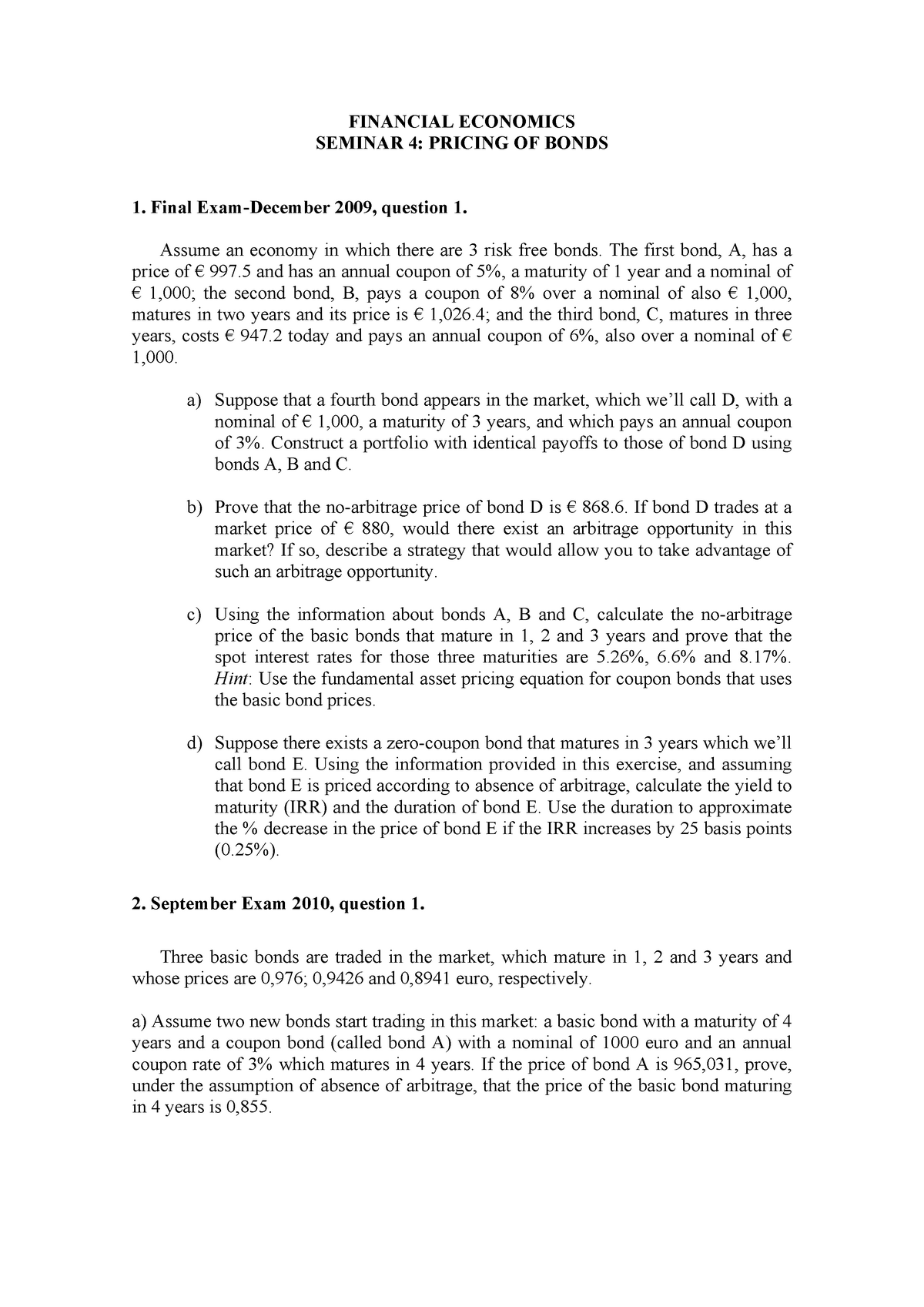

43 advantage of zero coupon bond

Uganda Government Bonds - Yields Curve Normally, longer-duration interest rates are higher than short-duration. So, the yield curve normally slopes upward as duration increases. For this reason, the spread (i.e. the yield difference) between a longer and a shorter bond should be positive. If not, the yield curve can be flat or inverted. Features and Advantages of Treasury Bills | Invest in T-Bills - Investmentz Zero-coupon securities - T-bills provide no interest on the total investments. Treasury bill investor earns the capital gains instead. An individual can buy the bill at the discounted rate and earn the face value rate upon maturity. Advantages: No risk involved - T-bills are issued by RBI and are supported by the Government of India.

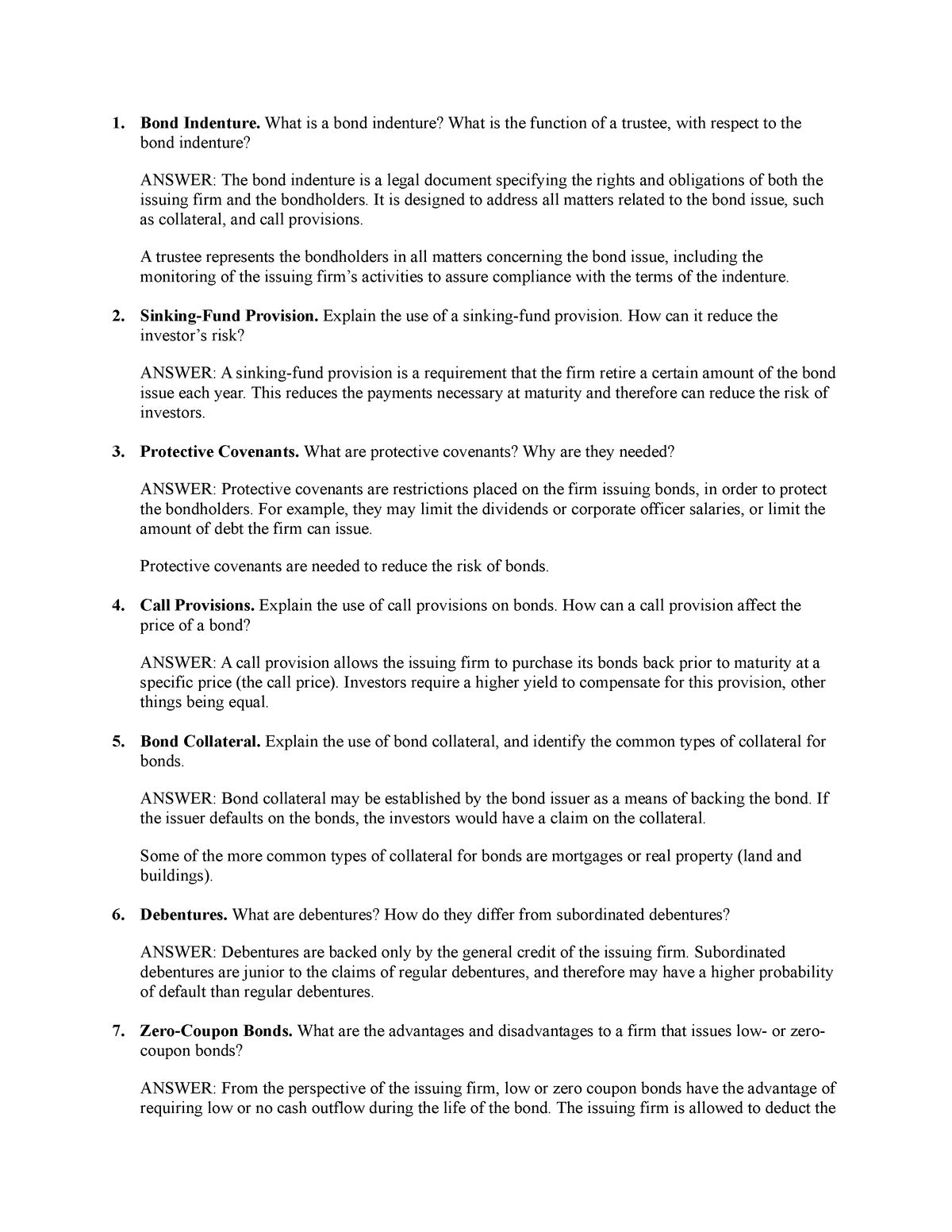

Exercise caution with zero-premium Medicare Advantage plans Health insurers will flood the Medicare Advantage market again this fall with enticing offers for plans that have no monthly price tag. The number of so-called zero-premium plans has been growing for years, and they can appeal to retirees who live on fixed incomes. Experts say shoppers should exercise caution, because they might find better coverage at a relatively small monthly cost.

Advantage of zero coupon bond

Key Features of Government Securities - NSE India Treasury bills have maturity of 91 days, 182 days and 365 days Government bonds and State Development Loans pay interest every six months Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value Advantages of investing in G-sec, SDL and T-bill Safety: Being Sovereign security, no default risk The 12 Best Debt Relief Companies for 2022 | Free Buyers Guide Over 10 years in business. 100% satisfaction guarantee. Since 2008, National Debt Relief has helped more than 100,000 families and individuals to pay off over $1 billion in unsecured debts. Their debt relief formula works primarily by negotiating with creditors to settle accounts for less than you originally owed. Dividend Discount Model - Definition, Formulas and Variations Another drawback is the sensitivity of the outputs to the inputs. Furthermore, the model is not fit for companies with rates of return that are lower than the dividend growth rate. Related Readings Thank you for reading CFI's guide to the Dividend Discount Model. To keep advancing your career, the additional resources below will be useful:

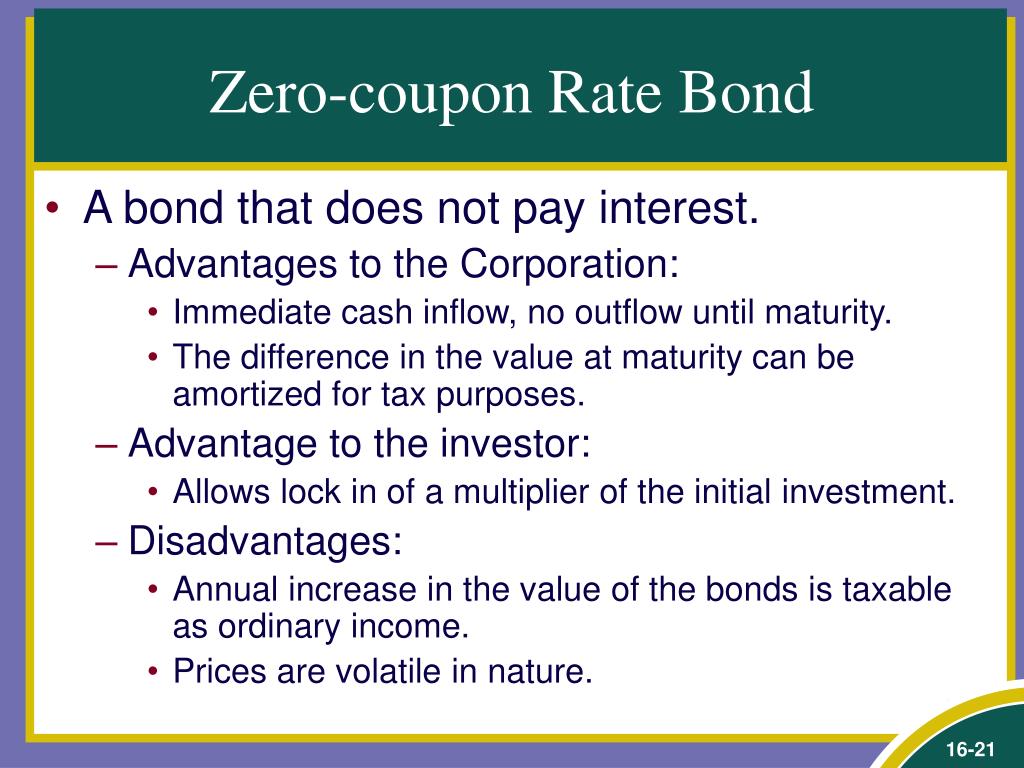

Advantage of zero coupon bond. Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... But I Bonds carry a real yield of 0.0%, based on the current fixed rate. This 9-year, 10-month TIPS has a real yield of 1.248%. That's a 125 basis-point advantage. I Bonds have many advantages over a TIPS: flexible maturity, better deflation protection, tax-deferred interest, ease of ownership. ZROZ | ETF Snapshot - Fidelity Holdings. Free commission offer applies to online purchases select ETFs in a Fidelity brokerage account. The sale of ETFs is subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). ETFs are subject to market fluctuation and the risks of their underlying investments. Option Chain: Fidelity Investments PIMCO 25+ YEAR ZERO COUPON US TREASURY INDEX ETF. $93.61 -0.31 (-0.33%) AS OF 4:10:00PM ET 10/04/2022 †. More Quote Information. Log in to find and filter single- and multi-leg options through our comprehensive option chain. Search for Calls & Puts or multi-leg strategies. Top 30 Capital Market Interview Questions - Great Learning Zero coupon bonds are bonds in which the face value or par value is repaid at the time of maturity of the bond, but the investor will purchase this bond at a discounted price. It does not make periodic interest payments, or they do not pay interest during the life of the bonds, hence the term zero coupon bond.

Advantage CoreAlpha Bond Fund | BCRIX | Institutional - BlackRock The Fund invests, under normal circumstances, at least 80% of the value of the Fund's net assets, plus the amount of any borrowing for investment purposes, in bonds. For the purposes of this strategy, "bonds" include the following: obligations issued or guaranteed by the U.S. Government, its agencies or instrumentalities; mortgage-backed securities issued or guaranteed by the U.S ... How to Invest in Bonds | The Motley Fool Not all bonds pay interest. Some bonds, known as zero-coupon bonds, offer a return once they've matured. Because these bonds don't pay interest, they are usually sold for a deep discount to their... Are Premium Bonds a good investment? - Times Money Mentor The chance of winning the £1m jackpot over the course of a year (or 12 monthly prize draws) is one in 49,563,028 if you have £100 in Premium Bonds. If you have £1,000 invested, the odds of ... Are Interest Rates Enough To Cause Such Chaos? | Seeking Alpha That 8.75% coupon rate is higher than the rate for CIM-A, but today GSL-B has an 8.65% yield. Yes, that means it is trading above $25.00. That's an extreme example of the way higher-yielding ...

India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.461% yield. 10 Years vs 2 Years bond spread is 34.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 5.90% (last modification in September 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Best Investment Sign-up Promotions In Singapore (2022) - SingSaver - S$10 Stock Cash Coupon - S$30 Stock Cash Coupon Bundle - 180 days of unlimited commission-free trades - Free market data access for SG and US stock exchanges and China A-shares - Free access to real-time Lvl 1 Market Data for the SG stock market - One chance to draw one free share worth between S$3 and S$2,500. 31 December 2022: StashAway: ETFs Norman Lehrer - Home The relationship between government bond yields and exchange rates is more complex than many investors realize. Read more. Bulletin Board . May 10, 2022 . Social Security: At a glance. August 19, 2022 . Municipal market insight. May 18, 2022 . Compounding Advantages of Zero Coupon Municipal Bonds. May 20, 2022 . Credit default swap - Wikipedia A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments (the CDS "fee" or "spread") to the seller and, in exchange, may expect to ...

Regional Payment and settlement System (REPSS) Treasury Auctions T-Bonds. EGP T-Bonds; EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; Variable Rate Repo; FX Auction. ... Advantages of REPSS: Minimize time of settlement period. Cost effective. The Central Bank of Egypt has started joining REPSS by end of ...

The Bond Market (aka Debt Market): Everything You Need to Know Advantages and Disadvantages of the Bond Market Most financial experts recommend that a well-diversified portfolio have some allocation to the bond market. Bonds are diverse, liquid, and lower...

End-to-end zero-touch automated bond trading is now possible with ... Sell-side fixed income desks can optimize their hit ratio and pricing margin with respect to market risk, trade size, inventory capacity and various other factors in automated corporate bond trading

Weekly market commentary | BlackRock Investment Institute Strategic view. Tactical view. Commentary Strategically, we are overweight publicly traded credit - from high yield to global investment grade. Higher spreads and government bond yields push up expected returns, and we think default risk is contained. Additionally, income potential is attractive.

Barclays BIL ETF: Keeping Powder Dry (NYSEARCA:BIL) On one hand, higher risk-free rates result in higher discount rates that negatively impact risk asset valuations and cause the price of shares and bonds to decline. On the other hand, higher...

Financial Glossary & Terms - Zacks Investment Research The total cost less total commission of all lots you own of a particular security divided by the total number of shares owned. Average Proceed The sum of net amounts received from all short open...

Why Senators Are Fighting to Help You to Buy More I Bonds Soon I Bonds Basics I Bonds are issued by the U.S. Government. They carry a zero-coupon interest rate which is adjusted twice annually for inflation. The rate will be 9.62% through October 2022, at...

Tax Shield - Formula, Examples, Interest & Depreciation Tax Deductible If this bond was converted, however, the net value of the lost tax shield is $800,000 (1 - 35%) = $520,000. The intuition here is that although we lose the $280,000 in tax shield, we gain the interest expense of $800,000 back (since we are not obliged to pay it out anymore). The net effect is -$280,000 + $800,000 = $520,000.

Government Bond: What It Is, Types, Pros and Cons - Investopedia T-Bonds give interest or coupon payments semi-annually and have $1,000 face values. The bonds help to offset shortfalls in the federal budget. Also, they help to regulate the nation's money supply...

General Obligation Bonds | The Motley Fool Because this bond comes with taxes specifically set aside for it, it's considered the strongest, most secure GO bond. An unlimited GO bond without dedicated taxes will pay out bondholders from...

What is PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded ... View PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ZROZ) investment & fund information. Learn more about ZROZ on Zacks.com

Dividend Discount Model - Definition, Formulas and Variations Another drawback is the sensitivity of the outputs to the inputs. Furthermore, the model is not fit for companies with rates of return that are lower than the dividend growth rate. Related Readings Thank you for reading CFI's guide to the Dividend Discount Model. To keep advancing your career, the additional resources below will be useful:

The 12 Best Debt Relief Companies for 2022 | Free Buyers Guide Over 10 years in business. 100% satisfaction guarantee. Since 2008, National Debt Relief has helped more than 100,000 families and individuals to pay off over $1 billion in unsecured debts. Their debt relief formula works primarily by negotiating with creditors to settle accounts for less than you originally owed.

Key Features of Government Securities - NSE India Treasury bills have maturity of 91 days, 182 days and 365 days Government bonds and State Development Loans pay interest every six months Treasury bills are zero coupon bonds. They are issued by discount and redeemed at face value Advantages of investing in G-sec, SDL and T-bill Safety: Being Sovereign security, no default risk

:max_bytes(150000):strip_icc():gifv()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "43 advantage of zero coupon bond"