45 coupon vs interest rate

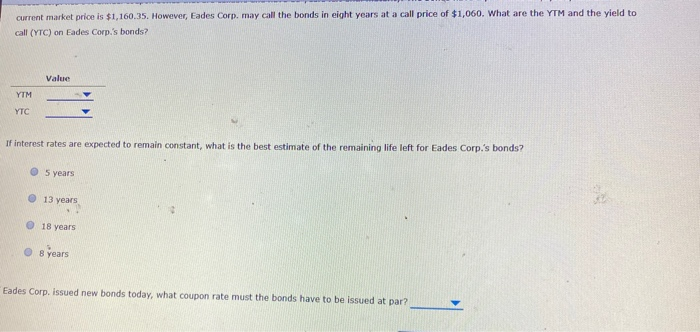

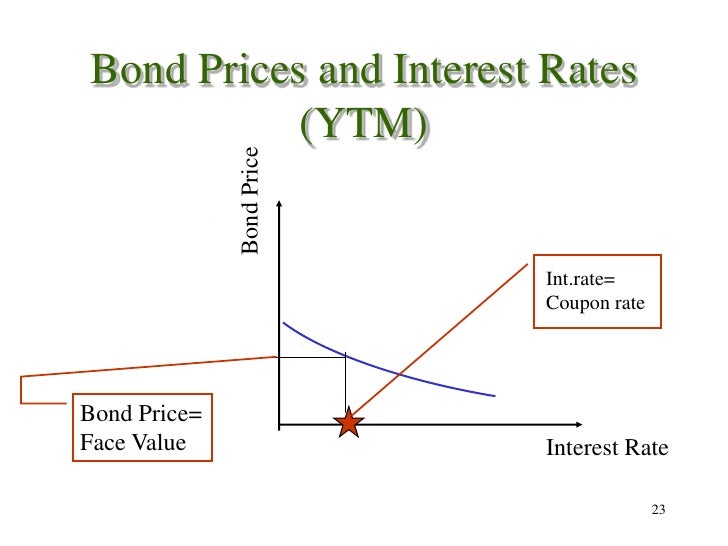

What is difference between coupon rate and interest rate? The Coupon Rate is 9%. It pays $90 per year since it was issued $90 is 9% of the original $1000 investment. The Bond Yield (aka, Current Yield) is 10%. 10% is your return this year, if you buy the bond at today's prices $90 is 10% of your $910 investment. The Yield to Maturity (YTM) is 13%. It's the only number that really matters. Difference Between Coupon Rate and Required Return The main difference between Coupon Rate and Required Return is that coupon rate is the constant value paid by the bond issuer at regular intervals until the bond matures, whereas required return is the amount accepted by the investor for assuming the responsibility of the stock and as an amount of compensation.

Coupon Payment | Definition, Formula, Calculator & Example A coupon payment is the amount of interest which a bond issuer pays to a bondholder at each payment date.. Bond indenture governs the manner in which coupon payments are calculated. Bonds may have fixed coupon payments, variable coupon payments, deferred coupon payments and accelerated coupon payments.. In fixed-coupon payments, the coupon rate is fixed and stays the same throughout the life ...

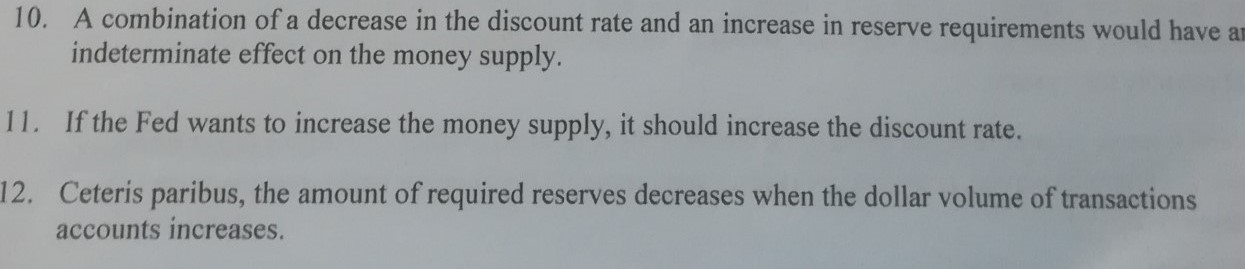

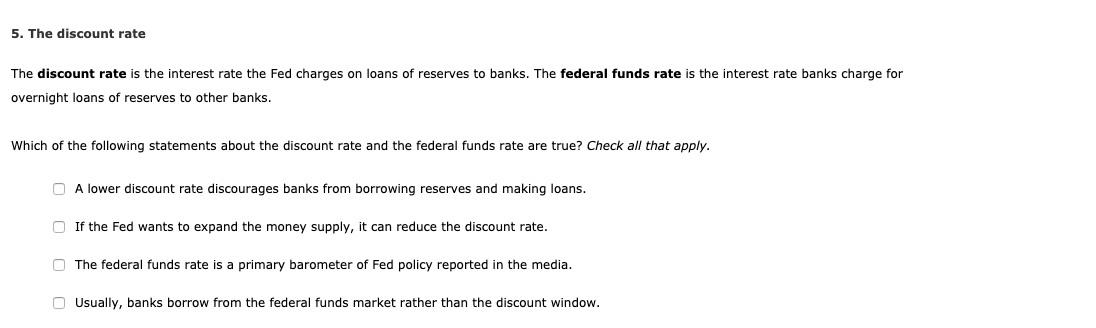

Coupon vs interest rate

Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender. Coupon vs Yield | Top 8 Useful Differences (with Infographics) Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date. CD Rate and APY: What's the Difference? - Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in...

Coupon vs interest rate. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... Coupon Rate vs Interest Rate | Top 6 Best Differences (With ... - EDUCBA The key difference between coupon rate vs interest rate is that interest rate is generally and in most of the cases are related to plain vanilla debt like term loans and other kinds of debt which are availed by companies and individuals for various business requirements. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Reinvestment Risk (Coupon) vs. Interest Rate Risk (Zero-Coupon) The high "interest rate risk" is reflected in the 10 which tells you (if we temporarily round off the difference between the Mod and Mac duration, maybe the Mod duratoin is 9.5, so ignore the difference): if the rate goes up by 1%, the price of your bond goes down by almost 10%. So we can use duration as a proxy for interest rate risk, hardly ...

What's the Difference Between Premium Bonds and Discount Bonds? A premium bond has a coupon rate higher than the prevailing interest rate for that bond maturity and credit quality. A discount bond, in contrast, has a coupon rate lower than the prevailing interest rate for that bond maturity and credit quality. An example may clarify this distinction. Let's say you own an older bond—one that was ... Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … APY vs Interest Rate: What Is the Difference [Guide for 2022] When calculating the interest rate vs APY, you need to multiply by 100 and get to a percentage to find the interest rate. If you multiply 0.053660387 by 100, you find the interest rate equals 5.366% (if the APY is 5.5 %, and interest is compounded monthly). What is Coupon Rate? Definition of Coupon Rate, Coupon Rate Meaning ... Coupon rate is not the same as the rate of interest. An example can best illustrate the difference. Suppose you bought a bond of face value Rs 1,000 and the coupon rate is 10 per cent. Every year, you'll get Rs 100 (10 per cent of Rs 1,000), which boils down to an effective rate of interest of 10 per cent.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) The key differences between Coupon Rate vs. Interest Rate are as follows - The coupon rate is calculated on the face value of the bond , which is being invested. The interest rate is calculated considering the basis of the riskiness of lending the amount to the borrower. The coupon rate is decided by the issuer of the bonds to the purchaser. Bond yield vs coupon rate: Why is RBI trying to keep yield down? An increase in YTM indicates below normal coupon rate or that the interest rates are forcibly kept low, resulting in fall in market value of the bonds. Tuesday, Jul 12, 2022. Coupon Rate Calculator | Bond Coupon For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate will still stay the same. Difference Between Coupon Rate and Interest Rate Main Differences Between Coupon Rate and Interest Rate Coupon rates are calculated on the fixed-income security, whereas interest rates are calculated on the amount which has been lent to borrowers. The coupon's face value determines the nominal value of the bond. Albeit the Interest rate's face value affected by the amount due on.

APR vs. Interest Rate: How are They Different? - MoneyWise The fees turn the interest rate into an APR of 3.37%. Loan B, which has an interest rate of 3%, 1 discount point costing $2,000, and $3,000 in other lender fees. The point and other fees turn the interest rate into an APR of 3.20%. Interest rates between the two loans differ by a quarter point (0.25).

CD Rate and APY: What's the Difference? - Fox Business In today's low interest-rate environment, the difference between the APY and the nominal rate is only a few hundredths of a percentage point. Using Bankrate's tool for comparing CD rates, in...

Coupon vs Yield | Top 8 Useful Differences (with Infographics) Let us discuss some of the major Difference Between Coupon vs Yield: The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

Difference Between Coupon Rate and Interest Rate In contrast, interest rate is the percentage rate that is charged by the lender of money or any other asset that has a financial value from the borrower. The main difference is that the decider of these rates; the coupon rate is decided by the issuer whereas the interest rate is decided by the lender.

Post a Comment for "45 coupon vs interest rate"