38 zero coupon bond journal entry

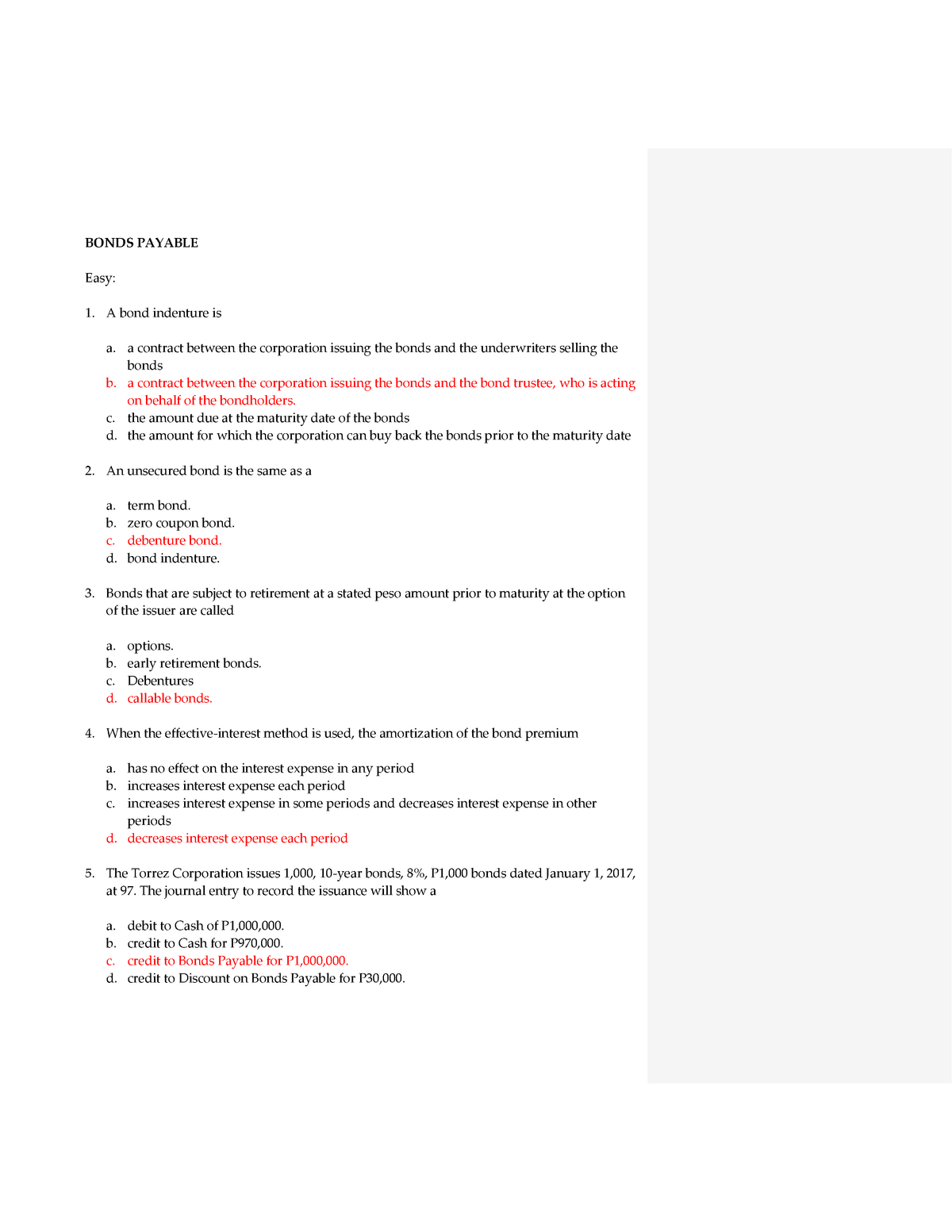

Zero Coupon Bond Issued At Discount Amortization And Accounting Journal ... accounting for a zero coupon bond issued at a discount (issue price less than face value) interest calculation and balance sheet recording, start with a cash flow diagram, face (maturity) value, no... Accounting for Zero-Coupon Bonds - XPLAIND.com A zero-coupon bond is a bond which does not pay any periodic interest but whose total return results from the difference between its issuance price and maturity value. For example, if Company Z issues 1 million bonds of $1000 face value bonds due to maturity in 5 years but which do not pay any interest, it is a zero-coupon bond.

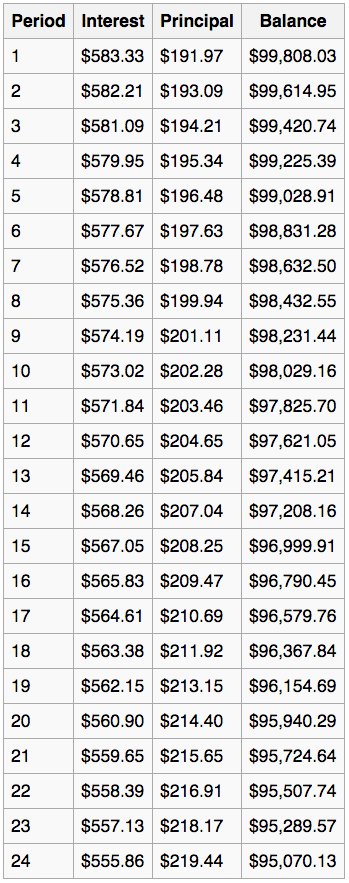

Zero Coupon Bonds Video Tutorial & Practice | Pearson+ Channels On January 1, ABC Company issues $1,000,000 of zero coupon bonds at 75. The bonds mature in five years. Assuming that ABC uses the straight-line method for amortization of bond premiums and discounts, the journal entry at the end of the first year would include: A. A credit to Cash of $50,000. B.

Zero coupon bond journal entry

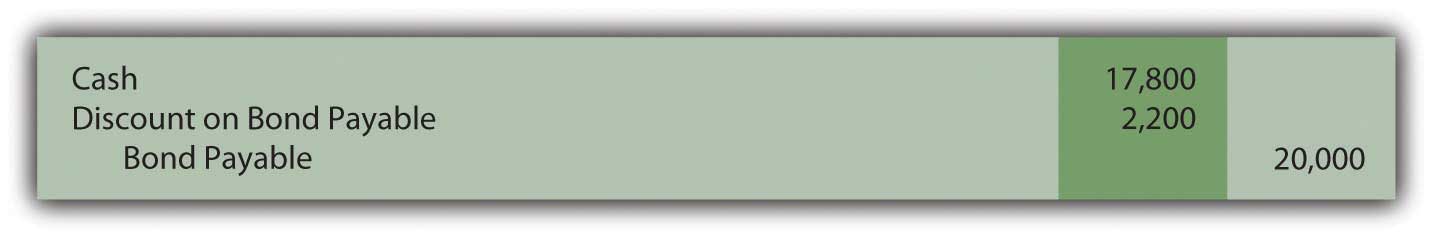

Bond amortization journal entry - Kunst onder de Wieken Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. Access Denied - LiveJournal Wij willen hier een beschrijving geven, maar de site die u nu bekijkt staat dit niet toe. Bonds Payable in Accounting | Double Entry Bookkeeping As the interest rate was identified on this coupon it became known as the bond coupon rate. A zero coupon bond is a bond which does not have coupons and therefore does not make interest payments. ... Bonds Payable Issued at Discount Journal Entry. The bond payable would be issued at a discount value of 92,640, and the journal entry to record ...

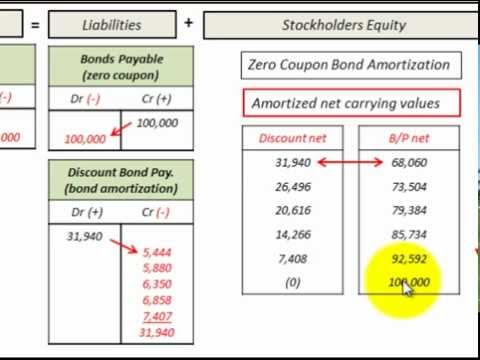

Zero coupon bond journal entry. Journal Entry for Zero Coupon Bonds | Accounting Education Now, we are ready to pass the journal entries of zero coupon bonds. For example, A company issues $ 20,000 zero coupon bond in the market. Mr. David bought it at the discount of $ 3471. It means Mr. David bought it at $ 16529 at 10% per year his earning. At the end of second year, company has to pay only face value of $ 20000. Bond amortization journal entry The full carrying amount of the bond is split up between common stock and additional paid-in capital. As a quick example, let's say that 100 bonds with a carrying value of $120,000 are exchanged for 1,000 shares of $1 par value stock. In the journal entry, the bond liability and premium would be removed.; Prepare a bond amortization schedule. 2-5. Prepare the journal … Accounting for Zero-Coupon Bonds - Lardbucket.org The entry shown in Figure 14.8 "January 1, Year One—Zero-Coupon Bond Issued at Effective Annual Interest Rate of 6 Percent" can also be recorded in a slightly different manner. Under this alternative, the liability is entered into the records at its face value of $20,000 along with a separate discount of $2,200. Accounting for Zero-Coupon Bonds - GitHub Pages Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000.

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant. First, the company will actually have to pay $20,000. Accounting Deep Discount Bonds - I GAAP & IFRS - CAclubindia A. Zero Coupon Bond (Deep Discount Bond) Zero-coupon bond (also called a discount bond or deep discount bond) is a bond issued at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments, or have so-called "coupons," hence the term zero-coupon bond. 3 Ways to Account for Bonds - wikiHow A similar entry is made to account for zero-coupon bond interest. For example, imagine a zero-coupon bond sold at a discount for $1,780 with a face value of $2,000 and a duration of 2 years. This represent an annual "interest" rate of 6 percent. ... Make a journal entry at bond maturity. When the bond comes to maturity, the face value is given ... Yield curve - Wikipedia Yield curves are usually upward sloping asymptotically: the longer the maturity, the higher the yield, with diminishing marginal increases (that is, as one moves to the right, the curve flattens out).According to columnist Buttonwood of The Economist newspaper, the slope of the yield curve can be measured by the difference, or "spread", between the yields on two-year and ten …

Fixed-income attribution - Wikipedia Fixed-income attribution is the process of measuring returns generated by various sources of risk in a fixed income portfolio, particularly when multiple sources of return are active at the same time.. For example, the risks affecting the return of a bond portfolio include the overall level of the yield curve, the slope of the yield curve, and the credit spreads of the bonds in the portfolio. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. 14 Bonds.pptx - CHAPTER 14 BONDS AND LONG-TERM NOTES 1... - Course Hero 15 Journal Entry by the issuer : Journal Entry by the bond investor: CASE 2: ... even interest expenses Zero coupon bonds are usually held by tax-exempt entities such as pension funds. 29 Face Value 10,000 Maturity 5 years Coupon Rate 0% Market Interest Rate 10% Issue price Interest expense over the life of the bond ... MAS - Maintenance Page This site is currently undergoing scheduled maintenance. Please come back and try again later. Thank you for your patience. For general enquiries, please contact webmaster@mas.gov.sg.

Accounting for Issuance of Bonds (Example and Journal Entry) Suppose ABC company issues a bond at a par value of $ 100,000 and a coupon rate of 5% with 5 years maturity. The market interest rate is also 5%. Let us calculate the PV of bond principal payment and interest component first. PV of bond = $ 100,000 × (0.78355) = $ 78,355. PV Factor 5%, 5 years = 0.78355. Coupon/Interest = $ 100,000 × 5% ...

Deferred Coupon Bond | Formula | Journal Entry - Accountinguide Company issue 1,000 zero-coupon bonds with a par value of $ 5,000 each. As the bonds do not provide any annual interest to the investors, so they have to be discounted and pay back the full value of par value. The market rate is 5% and the term of the bonds is 4 years. Please calculate the bond price that company needs to sell to attract investors.

Yield curve - Wikipedia There is a time dimension to the analysis of bond values. A 10-year bond at purchase becomes a 9-year bond a year later, and the year after it becomes an 8-year bond, etc. Each year the bond moves incrementally closer to maturity, resulting in lower volatility and shorter duration and demanding a lower interest rate when the yield curve is rising.

39 zero coupon bond journal entry - onina-levis501.blogspot.com 39 zero coupon bond journal entry. June 11, 2022. Accounting for Zero-Coupon Bonds - GitHub Pages Figure 14.9 December 31, Year One—Interest on Zero-Coupon Bond at 6 Percent Rate If a discount is recorded in the initial entry as is shown in the previous footnote, the credit here is to the Discount account and not directly to the bond payable.

Journal Entries of Zero Coupon Bonds - YouTube Investor gets earning buy getting the zero coupon bonds at discount. This discount will be the income of investor and second side, company has to show it as interest which not in cash but it is the...

Accounting for Convertible Bonds & Debt (with Examples) - WallStreetMojo a) Bonds are not converted at the time of maturity. This is also known as the repurchase of bonds. In this case, the bondholders are paid the maturity amount, and only the liability portion accounted for earlier will have to be derecognized. The maturity amount will be paid to the bondholders. Journal entry for the same will be as follows:

14.3: Accounting for Zero-Coupon Bonds - Business LibreTexts Figure 14.10 December 31, Year Two—Interest on Zero-Coupon Bond at 6 Percent Rate. Note that the bond payable balance has now been raised to $20,000 as of the date of payment ($17,800 + $1,068 + $1,132). In addition, interest expense of $2,200 ($1,068 + $1,132) has been recognized over the two years.

Zero Coupon Bonds's Journal Entries | Svtuition Zero Coupon Bonds's Journal Entries Journal Entries of Zero Coupon Bonds Watch on Zero coupon bonds are the famous type of bonds in which the company will gives only face value without paying any extra discount. Investor gets earning buy getting the zero coupon bonds at discount.

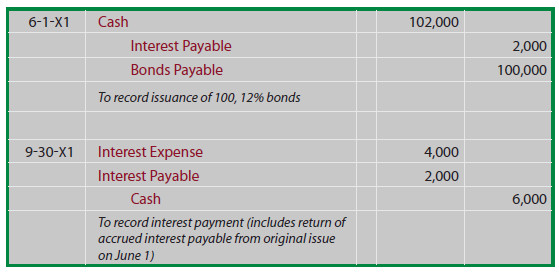

Recording Entries for Bonds | Financial Accounting - Course Hero Bonds Payable. 100,000. To record bonds issued at face value. On each June 30 and December 31 for 10 years, beginning 2010 June 30 (ending 2020 June 30), the entry would be ( Remember, calculate interest as Principal x Interest x Frequency of the Year ): Debit. Credit.

Commodity Codes Look-Up – Purchasing Commodity Code Search Find the NIGP code you need NIGP Code Listing This look-up uses the National Institute of Government Purchasing Codes (NIGP). For a detailed explanation of the NIGP Code used, please visit our NIGP Code Explained webpage. To use this look-up, click on a commodity category below to...

Zero Interest Bonds | Formula | Example | Journal Entry - Accountinguide Please prepare the journal entry during issuing and the annual interest expense. As the company issue bonds at zero interest rate, we need to calculate the selling price first. Selling price = $ 100/ (1+6%)^5 = $ 74.72 Company needs to sell bonds at $ 74.72 per bond. So the company will receive the cash of $ 74,270 for selling 1,000 bonds.

Answered: On January 1, 2022, Broncos Universal… | bartleby 01-01-2022 · Determine the price of the bonds at January 1, 2022. 2. Prepare the journal entry to record the bond issuance on January 1, 2022. 3. Prepare the journal entry to record interest on June 30, 2022, using the effective interest method. 4. Prepare the journal entry to record interest on December 31, 2022, using the effective interest method.

Business News, Personal Finance and Money News - ABC News 26-08-2022 · Find the latest business news on Wall Street, jobs and the economy, the housing market, personal finance and money investments and much more on ABC News

Solved Prepare the following journal entry: January 1, 2015 ... - Chegg Zero-coupon bonds earn interest as time passes for financial and tax reporting, but the issuer does not pay; Question: Prepare the following journal entry: January 1, 2015: Purchased $100,000 face value of zero-coupon bonds for $68,058. These bonds mature on December 31, 2019, and are priced on the market at the time of issuance to yield 8% ...

Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between...

Zero Coupon Bond Questions and Answers | Homework.Study.com Your company wants to raise $10 million by issuing 20-year zero-coupon bonds. If the yield to maturity on the bonds will be 6% (annually compounded APR), what total principal amount of bonds must...

Journal Entry for Bonds - Accounting Hub Therefore, the journal entry for semiannual interest payment is as follow: This interest payment will start from June 30, 2020, until December 31, 2039. At the maturity date, which is on December 31, 2039, the bonds will need to retire. Thus, ABC Co needs to repay back the principal of the bonds to the bondholders.

MAS - Maintenance Page This site is currently undergoing scheduled maintenance. Please come back and try again later. Thank you for your patience. For general enquiries, please contact webmaster@mas.gov.sg.

Chapter 14 Flashcards | Quizlet On January 1, 20X1, Meister Company issues $200,000 of 6% bonds. Interest of $6,000 is payable semiannually on June 30 and December 31. The bonds mature in 5 years. The bonds were issued at face amount. All the bonds are privately placed with one investor. On the date of issue, the investor should record what journal entry? (Select all that apply.)

Fixed-income attribution - Wikipedia For instance, a bond paying a 10% annual coupon will always pay 10% of its face value to the owner each year, even if there is no change in market conditions. However, the effective yield on the bond may well be different, since the market price of the bond is usually different from the face value. Yield return is calculated from

Chapter 14 Flashcards | Quizlet On January 1, 20X1, Meister Company issues $200,000 of 6% bonds. Interest of $6,000 is payable semiannually on June 30 and December 31. The bonds mature in 5 years. The bonds were issued at face amount. All the bonds are privately placed with one investor. On the date of issue, the investor should record what journal entry? (Select all that apply.)

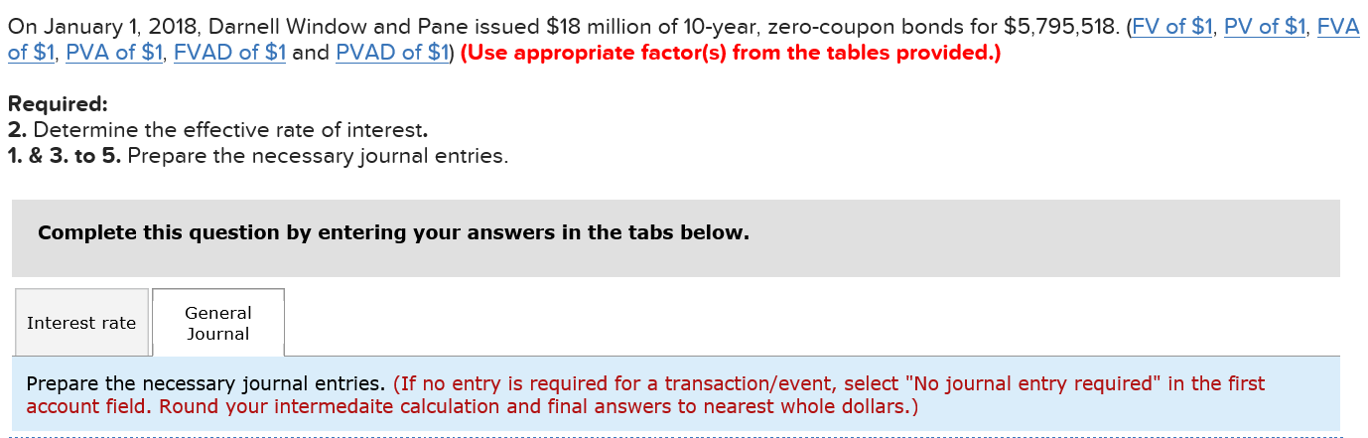

Solved On January 1, 2024, Rodriguez Window and Pane issued - Chegg On January 1, 2024, Rodriguez Window and Pane issued $19.9 million of 10-year, zero-coupon bonds for $6, 407, 267. Required: 2. Determine the effective rate of Interest. ... to nearest whole dollar. Journal entry worksheet 4 Record the issuance of the bonds. Note: Enter debits before credits. Journal entry worksheet 4 Record annual interest ...

Convertible zero-coupon bonds - journal entry - Ask Me Help Desk Code: 3M originally sold $639 million in aggregate face amount of these "Convertible Notes" (zero-coupon bonds with maturity 30 years) on November 15, 2002, which are convertible into shares of 3M common stock. The gross proceeds from the offering, to be used for general corporate purposes, were $550 million ($540 million net of issuance costs).

Questia - Gale Questia. After more than twenty years, Questia is discontinuing operations as of Monday, December 21, 2020.

What Is a Zero-Coupon Bond? - The Motley Fool Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able to purchase a bond for $6,139.11, wait 10 years, and redeem it for $10,000....

Commodity Codes Look-Up – Purchasing Data Entry and Remote Job Entry Devices, Voice Activated: Voice Recognition, Voice Digitization, Speech Synthesizers, etc. 206-44 Drives: Compact Disk, ROM, etc. 206-45 Drives: Floppy Disk 206-46 Drives: Hard/Fixed Disk 206-47 Drives, Tape 206-51

Answered: On January 1, 2022, Broncos Universal… | bartleby Jan 01, 2022 · Determine the price of the bonds at January 1, 2022. 2. Prepare the journal entry to record the bond issuance on January 1, 2022. 3. Prepare the journal entry to record interest on June 30, 2022, using the effective interest method. 4. Prepare the journal entry to record interest on December 31, 2022, using the effective interest method.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Bonds Payable in Accounting | Double Entry Bookkeeping As the interest rate was identified on this coupon it became known as the bond coupon rate. A zero coupon bond is a bond which does not have coupons and therefore does not make interest payments. ... Bonds Payable Issued at Discount Journal Entry. The bond payable would be issued at a discount value of 92,640, and the journal entry to record ...

Access Denied - LiveJournal Wij willen hier een beschrijving geven, maar de site die u nu bekijkt staat dit niet toe.

Bond amortization journal entry - Kunst onder de Wieken Question: This $20,000 zero-coupon bond is issued for $17,800 so that a 6 percent annual interest rate will be earned. As shown in the above journal entry, the bond is initially recorded at this principal amount. Subsequently, two problems must be addressed by the accountant.

![Solved Problem 14-9 Zero-coupon bonds [LO14-2] On January 1 ...](https://media.cheggcdn.com/media%2F9ad%2F9ad34cfc-6284-4b32-be48-7a9d32192c87%2FphplCm2SQ.png)

Post a Comment for "38 zero coupon bond journal entry"