45 coupon rate of bond

worldscholarshipforum.com › wealth › fixed-rate-bonds9 Best Fixed Rate Bonds In 2022 | Expert Guide According to Investopedia.com, a fixed-rate bond is a type of debt instrument that pays a fixed coupon rate for the duration of the bond. Fixed-rate bonds are of two types; The Normal fixed-rate bonds that offer a fixed interest rate for the period of the bond and Tracker rate bonds that give out fixed interest rates at an agreed level. What Is a Coupon Rate? And How Does It Affects the Price ... A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer of zero-coupon bonds only pays the face value of bonds at the maturity date. Instead of paying coupon interest, the bond issuer issues the bonds at price less than the face value. The discount of issue effectively represents the interest and yield for investors ...

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000

Coupon rate of bond

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link Coupon rate financial definition of Coupon rate The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

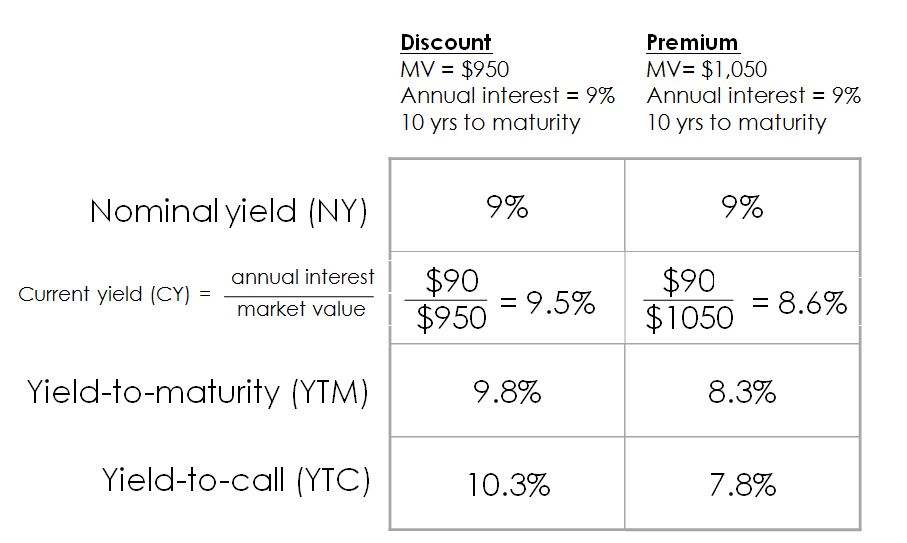

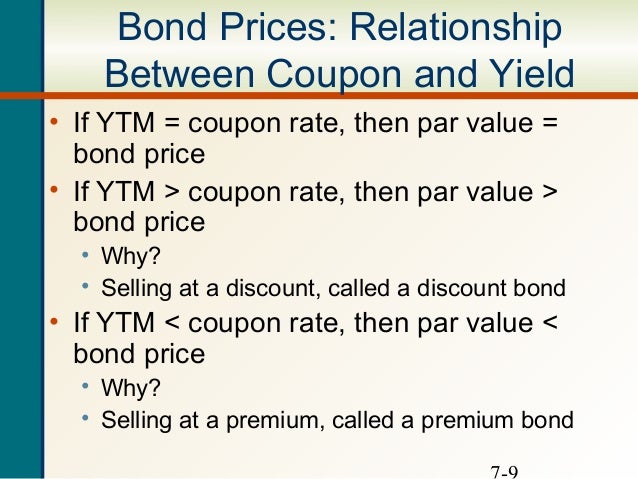

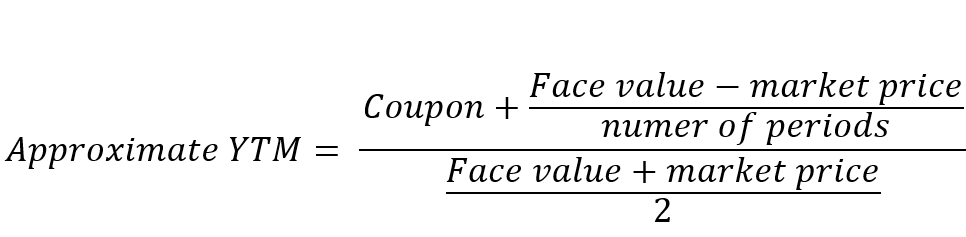

Coupon rate of bond. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. Coupon Rate - Meaning, Calculation and Importance To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Difference Between Coupon Rate and Discount Rate (With ... The standard worth is essentially the assumed worth of the bond or the price of the bond as expressed by the responsible substance. Subsequently, a $1,000 security with a coupon pace of 6% pays $60 in revenue yearly, and a $2,000 protection with a coupon pace of 6% pays $120 in revenue every year. What is Discount Rate? maturity debt funds: Constant maturity debt funds gain in ... When bond yields rise, bond prices fall and the reverse too is true. This is termed interest rate risk. When the duration of a bond's portfolio - a measure of the bond's interest rate risk calculated using maturity, coupon and current yield - is high, the interest rate risk is also high, and vice versa.

Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms . Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest. The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions.) Coupon Rate Definition & Example | InvestingAnswers The coupon rate on the bond is 5%, which means the issuer will pay you 5% interest per year, or $50, on the face value of the bond ($1,000 x 0.05). Even if your bond trades for less than $1,000 (or more than $1,000), the issuer is still responsible for paying the coupon based on the face value of the bond. What Is Coupon Rate and How Do You Calculate It? A bond coupon rate is a fixed payment, meaning that it will remain the same for the lifetime of the bond. For example, you can purchase a 10-year bond with a face value of $100 and a bond coupon rate of 5%.

Coupon Rate of a Bond - Harbourfront Technologies Based on these steps, the formula to calculate the coupon rate of a bond is as follows. Coupon Rate of a Bond = Total Annual Coupon Payment / Par Value of Bond x 100%. For example, a bond offers a total annual coupon payment of $50. The bond's par value is $1,000. Therefore, its coupon rate will be 5% ($50 / $1,000 x 100). Fixing of coupon rates - Nykredit Realkredit A/S Bonds with quarterly interest rate fixing The new coupon rates will apply from 29 April 2022 to 29 July 2022: Uncapped bonds DK0030482922, (SNP), maturity in 2024, new rate as at 29 April 2022: 1 ... How To Find Coupon Rate Of A Bond On Financial Calculator Coupon Rate = (Coupon Payment / Par Value) x 100 For example, you have a $1,000 par value bond with an annual coupon payment of $50. The bond has 10 years until maturity. Using the formula above, we would calculate the coupon rate as follows: Coupon Rate = ($50 / $1,000) x 100 = 5% Own or Dealer Bid Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate.

Difference Between Coupon Rate and Interest Rate (With ... The coupon rate is the annual rate of the bond that has to be paid to the holder. Also, it depends on the par value, that is, the face value of the band during the issue period. Following that, there would be no changes to the payment, as the rate is fixed completely till the expiry of the bond.

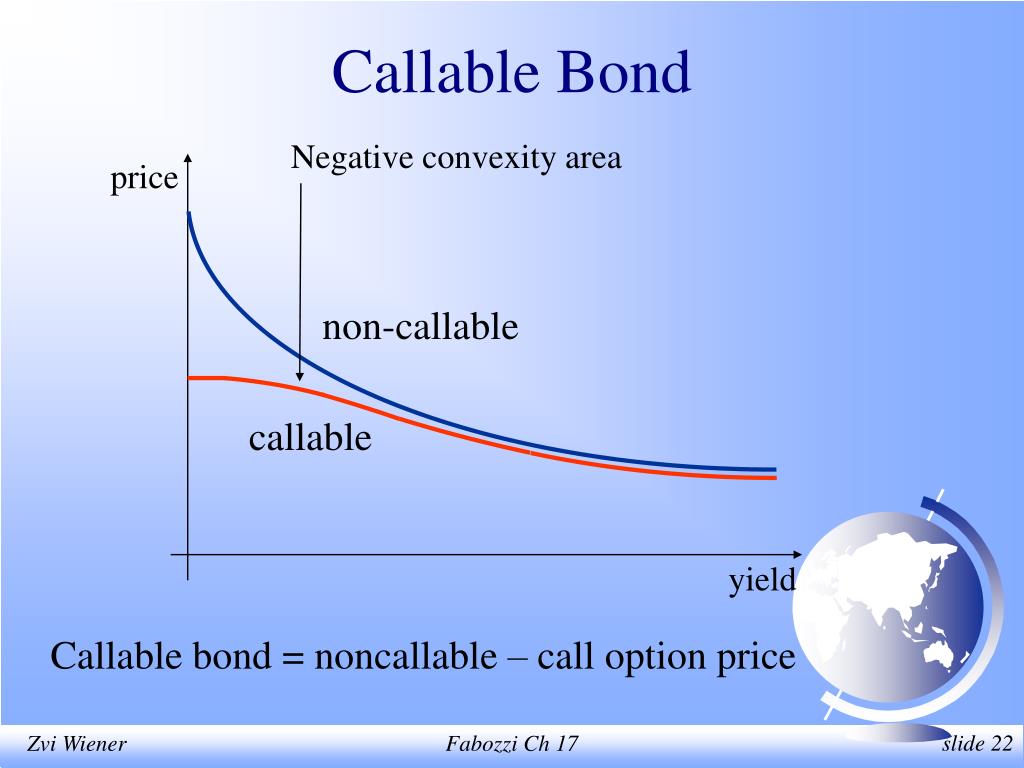

What is a Coupon Rate? | Bond Investing | Investment U Coupon rates play a significant role in dictating demand for certain bonds. They come fixed at the time of issuance, while interest rates change. This means the two work in tandem to drive bond prices—and thus, demand for bonds. If the rate is higher than the current interest rate, bonds will trade at a premium.

Floating rate note - Wikipedia Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like LIBOR or federal funds rate, plus a quoted spread (also known as quoted margin).The spread is a rate that remains constant. Almost all FRNs have quarterly coupons, i.e. they pay out interest every three months.

What Is Coupon Rate of a Bond | The Fixed Income | Bond ... A coupon rate, simply put, is the interest rate at which an investor will get fixed coupon payments paid by the bond issuer on an annual basis over the period of an investment. In other words, the coupon rate on a bond when first issued gets pegged to the prevailing interest rate, and remains constant over the duration of an investment.

Bond Coupon Interest Rate: How It Affects Price A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond's...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment.

Coupon Rate Definition - investopedia.com The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity...

United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. Skip to content. Markets ... Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year . 0.13: 103.32- ...

› list › ls026922640Every 007 James Bond Movie List - IMDb James Bond has left active service. His peace is short-lived when Felix Leiter, an old friend from the CIA, turns up asking for help, leading Bond onto the trail of a mysterious villain armed with dangerous new technology. Director: Cary Joji Fukunaga | Stars: Daniel Craig, Ana de Armas, Rami Malek, Léa Seydoux. Votes: 341,581 | Gross: $160.87M

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

What is Coupon Rate? Definition of Coupon Rate, Coupon ... Definition: Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value.

Coupon rate financial definition of Coupon rate The coupon rate is the interest rate that the issuer of a bond or other debt security promises to pay during the term of a loan. For example, a bond that is paying 6% annual interest has a coupon rate of 6%. The term is derived from the practice, now discontinued, of issuing bonds with detachable coupons.

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link

What Is the Coupon Rate of a Bond? A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%.

Post a Comment for "45 coupon rate of bond"